Author: Natalie Le

RELEASE: New Website Sheds Light On ObamaCare Troubles – BrokenObamaCarePromises.com

October 26, 2015

Victoria Coley: victoria.coley@iwvoice.org

Celia Meyer: celia.meyer@iwvoice.org

New Website Sheds Light On ObamaCare Troubles

BrokenObamaCarePromises.com

Giving A Voice To Those Harmed By ObamaCare

Higgins: “The millions of Americans and their families who have been adversely affected by the ironically named “Patient Protection & Affordable Care Act” deserve a better healthcare system, and, certainly deserve to have their voices heard.”

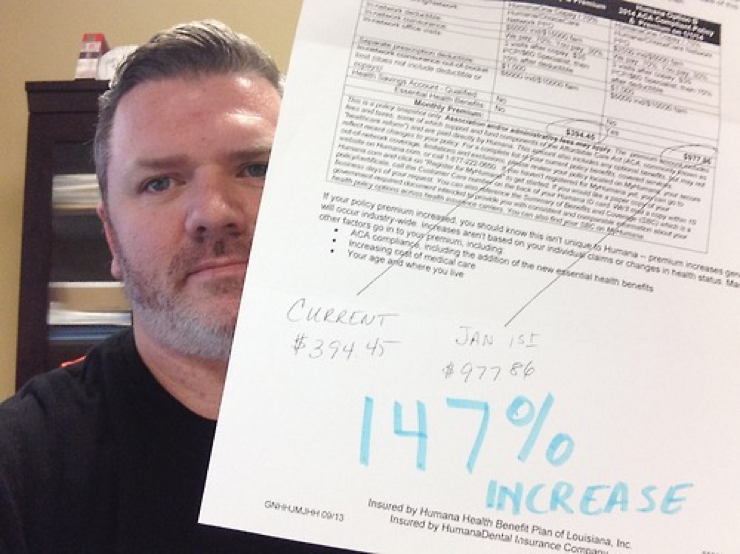

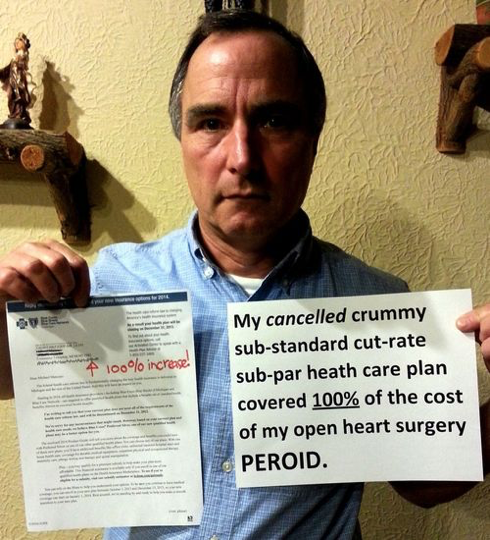

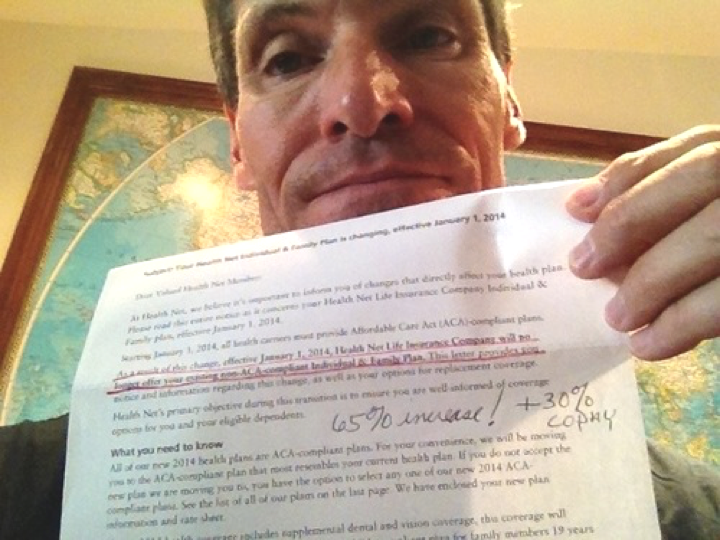

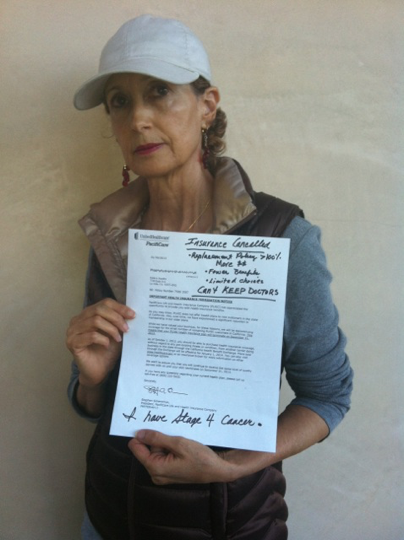

WASHINGTON D.C. — Launching today, a new multi-layered online initiative from the Independent Women’s Voice, BrokenObamaCarePromises.com, invites the public to share their stories of real life experiences with the healthcare law, giving a face to the millions harmed by the law’s broken promises.

President Obama promised that if we liked our plan, we could keep it, but millions of Americans then had their health insurance policies cancelled. Individuals and families were assured ObamaCare would be affordable, but too many have suffered staggering insurance cost increases. Then, Americans discovered their doctor networks and prescription coverage were being limited under ObamaCare. Many poor cancer patients have discovered that now that they are “covered”, it is illegal for cancer treatment centers to give them real treatment as charity, but only are served at places that shunt them to hospice to die rather than treating them. After more than five years of health reform, Americans have proof that all of these promises have consistently been broken.

“Time and again, we have learned that ObamaCare won’t actually do what its proponents promised it would. Americans can expect more broken promises to come,” IWV CEO and President Heather R. Higgins said. “ObamaCare provides neither ‘patient protection’ or ‘affordable care.’ A promise of care that no one will fulfill is no promise, and choices that are only lousy options you never wanted isn’t a choice. Americans and their families who have fallen victim to the law deserve a better healthcare system, and in the meantime, certainly deserve to have their voices heard.”

In 2013, IWV launched My Cancellation, which featured submissions from Americans across the country who received letters from their health insurance providers notifying them that their plans – that they liked – would be cancelled due to ObamaCare. Thousands sent IWV their stories, representing the experience of millions nationwide. Unfortunately, since that time, there have been even more broken ObamaCare promises, and the American people are the ones paying the price.

Broken ObamaCare Promises asks anyone who has been impacted by any of ObamaCare’s staggering harms to submit their story to mystory@brokenobamacarepromises.com. Video testimonials are encouraged.

###

Broken ObamaCare Promises is committed to giving a voice to all Americans who have been harmed by ObamaCare. Broken ObamaCare Promises is an initiative of Independent Women’s Voice’s A Bridge to Better Healthcare project. Independent Women’s Voice is a 501(c)(4) nonpartisan, nonprofit organization for mainstream women, men and families. IWV is the sister organization of the Independent Women’s Forum.

The Decline of ObamaCare

Fewer enrollees and rising loss ratios will force a rewrite in 2017.

Photo: Bloomberg News

Updated Oct. 25, 2015 9:52 p.m. ET

ObamaCare’s image of invincibility is increasingly being exposed as a political illusion, at least for those with permission to be honest about the evidence. Witness the heretofore unknown phenomenon of a “free” entitlement that its beneficiaries can’t afford or don’t want.

This month the Health and Human Services Department dramatically discounted its internal estimate of how many people will join the state insurance exchanges in 2016. There are about 9.1 million enrollees today, and the consensus estimate—by the Congressional Budget Office, the Medicare actuary and independent analysts like Rand Corp.—was that participation would surge to some 20 million. But HHS now expects enrollment to grow to between merely 9.4 million and 11.4 million.

Recruitment for 2015 is roughly 70% of the original projection, but ObamaCare will be running at less than half its goal in 2016. HHS believes some 19 million Americans earn too much for Medicaid but qualify for ObamaCare subsidies and haven’t signed up. Some 8.5 million of that 19 million purchase off-exchange private coverage with their own money, while the other 10.5 million are still uninsured. In other words, for every person who’s allowed to join and has, two people haven’t.

Among this population of the uninsured, HHS reports that half are between the ages of 18 and 34 and nearly two-thirds are in excellent or very good health. The exchanges won’t survive actuarially unless they attract this prime demographic: ObamaCare’s individual mandate penalty and social-justice redistribution are supposed to force these low-cost consumers to buy overpriced policies to cross-subsidize everybody else. No wonder HHS Secretary Sylvia Mathews Burwell said meeting even the downgraded target is “probably pretty challenging.”

The HHS survey shows three of four ObamaCare-eligible uninsured people think having coverage is important—but four of five say they couldn’t fit their share of the premiums into their budgets even after the subsidies. They’re not poor; they tend to have jobs in industries like construction, retail and hospitality but feel insecure financially; and they prioritize items like paying down debt, car repairs or saving to buy a home over insurance.

The law’s failure to appeal to the young and rising middle class is already cascading through the insurance markets. Researchers at the Robert Wood Johnson Foundation and Urban Institute recently published a remarkable study of the industry barometer called medical loss ratios, or MLRs, and the pressure is building fast.

MLRs measure the share of premium revenue that flows to reimbursing medical claims. ObamaCare sets an MLR floor of 80% for patient care, with one-fifth left over for overhead like administration and profits, and the pre-ObamaCare 2010-13 historical trend for the individual market ranged from 79% to 86%.

The researchers found that in 2014—the first full year of claims experience in ObamaCare—average MLRs across all health plans sold on 16 state exchanges roamed from 90% to 99%. Average MLRs in 11 states climbed to 100% or more, reaching as high as 121% in Massachusetts. A business can’t stay solvent for long spending $1.21 for every $1 that comes in.

The 2014 MLRs are used to set rates for 2016 premiums, which are still under regulatory review. But the researchers estimate that to rebound to an MLR of 85%, premiums in the 11 money-losing states need to rise by 10% to 36% in the best estimate and 23% to 52% in the worst scenario. The familiar danger is that as rates rise, more people drop out, and thus rates must rise still higher, as the states that attempted ObamaCare-like regulatory schemes in the 1980s and 1990s discovered.

ObamaCare liberals pose as what-works-and-what-doesn’t technocrats. So perhaps they’d care to explain what it says about their creation that so many rational adults are willing to pay a fine of $695 or 2.5% of their earnings, whichever is higher, for the privilege of not buying an ObamaCare-compliant health plan.

***

ObamaCare will almost inevitably be reopened in 2017, whoever wins the election. The good news is the emerging consensus among Republican candidates about a credible, pragmatic and optimistic alternative. Jeb Bush was the latest to release a plan two weeks ago—and this is a debate that has always deserved to be litigated at the presidential level to create a mandate for reform.

The basic approach is to deregulate insurance and medical practice while replacing ObamaCare’s complex subsidy schedule with a refundable tax credit for individuals who lack job-based coverage. Unchained from benefit and redistribution mandates, insurance products and prices would come to reflect what consumers want. The credit would be sufficient to buy at least coverage for catastrophic expenses if people get sick, and the trade-offs of such skinnier plans might look better to voters priced out of ObamaCare.

GOP reformers also recognize that the Cadillac tax on high-cost employer-sponsored health plans is a heat shield that might let them solve some of the problems of the pre-2010 health finance status quo. Substituting a cap on the tax-code subsidy that helps drive medical inflation is more politically plausible with the Cadillac tax in place than without.

Mr. Bush was shrewd to frame his proposal with the vocabulary of innovation and aspiration. ObamaCare is built on a 20th-century chassis that is ever less relevant to modern medicine and consumer finance. If the law continues to underperform, voters may be open to a new model that puts their choices and needs ahead of the political class’s.

Health Care Co-op Closings Narrow Consumers’ Choices

By Reed Abelson and Abby Goodnough Oct. 25, 2015

The grim announcements keep coming, picking up pace in recent weeks.

About a third, or eight, alternative health insurers created under President Obama’s health care law to spur competition that might have made coverage less expensive for consumers are shutting down. The three largest are among that number. Only 14 of the so-called cooperatives are still standing, some precariously.

The toll of failed co-op insurers, which were intended to challenge dominant companies that wield considerable power to dictate prices, has left about 500,000 customers scrambling to find health insurance for next year. A ninth co-op, which served Iowa and Nebraska, closed in February.

At a time when the industry is experiencing a wave of consolidation, with giants like Anthem and Aetna planning to buy their smaller rivals, the vanishing co-ops will leave some consumers with fewer choices — and potentially higher prices.

The failures include co-ops in New York, Colorado, Kentucky and South Carolina.

The shuttering of these start-ups amounts to what could be a loss of nearly $1 billion in federal loans provided to help them get started. And the cascading series of failures has also led to skepticism about the Obama administration’s commitment to this venture.

Some policy analysts say they were doomed from the beginning.

Republican critics of the health law are seizing upon the issue, and many leaders of the closing co-ops say the government’s actions contributed to their problems.

“They may have been the kamikaze pilots for health care reform,” said Mark A. Hall, a health policy professor at Wake Forest University.

Created as a concession to Democrats who wanted the health care law to include a government-run plan as an alternative to private insurers, the co-ops faced significant hurdles from the start. The Republican-controlled Congress slashed their initial funding to $2.4 billion from $6 billion and, more recently, restricted the administration’s ability to help insurers with unexpectedly large costs in the first few years of the new exchanges.

Former Senator Kent Conrad, the North Dakota Democrat who proposed the co-ops, said they were “sabotaged.”

“Those who wanted to kill them — largely Republicans and competing insurance companies — just step by step took actions to subvert them and to assure they would have an extraordinarily difficult time surviving,” he said.

The administration says it is doing what it can. Kevin Counihan, chief executive of the federal insurance marketplace, said Sylvia Mathews Burwell, secretary of health and human services, considers the co-op program a priority.

As consumer-governed start-ups, the co-ops tried to sell some of the lowest-cost plans that would put downward pressure on prices. They offered one of the two least expensive midrange plans in more than half the counties where they operated this year, according to the Kaiser Family Foundation, especially in rural areas that have historically suffered from a lack of competition and high prices.

But the co-ops’ low prices left them vulnerable to significant losses. Without the necessary financing to keep them afloat, many are crashing.

After the Republicans insisted late last year on limiting the ability of the administration to pay for one of the programs to protect the insurers from losses in the early years, administration officials say they had few, if any, options. “Those were the deck of cards that we had to work with,” Mr. Counihan said, adding that the insurers should have not have been surprised.

This month, all insurance companies that incurred unexpected losses selling plans through the new exchanges learned that they would get less than 13 cents of every dollar the federal government owes them for 2014. Many of the failed co-ops described that turn of events as their undoing. While most private insurers have enough reserves or access to funds to continue to operate, state regulators shut down some of the co-ops because of solvency concerns. Federal officials say the insurers will eventually receive more of what they were owed.

The co-ops say the administration has left many of them with few choices. “These are closures because of unkept promises,” said Kelly Crowe, the chief executive of the National Alliance of State Health Co-ops.

Even after Congress demanded changes to the program, the co-ops say they were reassured that they would be paid more of what they were due. “We were blindsided,” said Julia Hutchins, the chief executive of Colorado HealthOP.

Ms. Crowe and others say the co-ops’ overseer, the Centers for Medicare and Medicaid Services, has also stymied their quest to find other sources of money. They have even sought solutions like teaming up with another nonprofit. “We’ve not seen any shift in the willingness of C.M.S. to consider or approve any model,” she said of the agency.

The co-ops, and some observers, believe the administration has been reluctant to take steps to try to save the struggling entities. Some analysts argue that some of the co-ops failed because they simply set their prices too low and would have failed eventually, even if they had received the money they were owed.

If an insurer was dependent on those payments to remain viable, “it was already too late,” said Deep Banerjee, a credit analyst with Standard & Poor’s, which had warned this year that many of the co-ops were vulnerable.

Mr. Counihan pointed out that more than half of all new health insurers do not succeed. The co-ops’ federal loans carried restrictions like not being able to use the funds for marketing that made their odds of surviving steeper than most.

But he also said that strong management was a common theme among the co-ops that have survived to this point.

He added, “We are continuing to look for any other ways that we can appropriately find funds” to help the remaining co-ops stay in business. He also said he had been involved in attempts for some of the co-ops to find outside capital, including in Kentucky, where a plan for the co-op to team up with a nonprofit Medicaid plan in Louisville failed.

He emphasized that the section of the Affordable Care Act laying out the rules for co-ops did not allow for much flexibility.

The co-op in Maine, Community Health Options, managed to achieve a surplus last year. Its chief executive, Kevin Lewis, said it had not counted on receiving any payments from the federal government through the program to protect from losses and had budgeted accordingly.

Counties that are mostly rural are disproportionately affected by the demise of the nine co-ops to date, according to the Kaiser Family Foundation’s analysis. In almost two-thirds of rural counties, they offered one of the two least expensive silver plans.

In some areas, their presence allowed consumers to choose among three insurers, which many experts say is the lowest number needed to put downward pressure on prices. Nevada will have four counties with only two choices, after the co-op and another insurer exited, and 10 counties with only a single choice: Anthem, according to Kaiser.

In Kentucky, where Kentucky Health Cooperative offered plans statewide and had 55,000 members this year, it would have been the third insurer offering plans in 59 of 120 counties for 2016, said Glenn Jennings, the co-op’s interim chief executive. Now people in those counties, which are mostly rural, will have just two choices.

But Mr. Jennings said he believed the co-op’s presence over the last two years “plowed ground for everybody” and led to more insurers entering the exchange, known as Kynect. Aetna and UnitedHealth Group are selling plans on the exchange for 2016, joining five other insurers who will sell in at least some regions of Kentucky.

“The co-op experiment has netted better choices for Kentuckians,” Mr. Jennings said.

But consumers are left without the alternative that co-ops offered: a new nonprofit insurer, run by customers of those plans.

Peter Kruty, 60, who owns a small printing business in Brooklyn, said he had no choice but to put up with expensive, disappointing health coverage from giant companies before the federal law took effect.

He and his wife signed up with Health Republic, which is now closing, for 2014, choosing a plan that provided generous benefits for $477 a month after their federal subsidy. They stuck with Health Republic this year even though their monthly premium rose to $623, Mr. Kruty said, because “for once we had really usable insurance” that did not deny claims.

Mr. Kruty’s broker had also recommended a plan from Empire Blue Cross Blue Shield, a unit of Anthem, but he was drawn to Health Republic after reading its mission statement, he said. “I liked what they stood for — a sense that everyone’s health is a community concern and we are all in this together,” he said.

A version of this article appears in print on October 26, 2015, on page B1 of the New York edition with the headline: Health Care Coop Closings Narrow Consumers’ Choices.

Unable To Keep Your Trusted Doctor

Thousands to Lose Insurance After Colorado Obamacare Co-Op Shuts Down

Bennet in 09: ‘If you have coverage and you like it, you can keep it’

October 19, 2015 4:14 pm

The biggest co-op in Colorado’s Obamacare exchange is folding, leaving 83,000 without health insurance.

The Associated Press reported:

Colorado HealthOP announced Friday that the state Division of Insurance has de-certified it as an eligible insurance company. That’s because the cooperative relied on federal support, and federal authorities announced last month they wouldn’t be able to pay most of what they owed in a program designed to help health insurance co-ops get established.

The Colorado announcement makes the co-op the seventh in the nation to collapse. Similar nonprofit insurers have already failed in Kentucky, Louisiana, Iowa/Nebraska, Nevada, New York and Tennessee.

Republicans are using the news to hit Democratic incumbent Sen. Michael Bennet, who promised in 2009 that the president’s health care law would not force people out of their insurance.

“If you have coverage and you like it, you can keep it,” he said. “If you have a doctor and you like him or her you should be able to keep them as well. We will not take those choices away from you.”

“The disastrous effects of Obamacare continue to take a devastating toll on Americans across the nation,” said Alleigh Marré, a spokesperson for the National Republican Senatorial Committee. “Michael Bennet should feel personally responsible for the nearly 83,000 Coloradans who will be left struggling to establish new healthcare because of his misguided and loyal support for Obamacare.”

Republican Sen. Cory Gardner also blamed “Obamacare’s broken promises” for the loss of health insurance for thousands of Coloradans.

“Taxpayers are on the hook for millions of dollars in loans given out to the CO-OP, money that will likely never be repaid,” he said. “The years since Obamacare’s passage have been marked by crisis after crisis in healthcare, and it’s far past time for a new plan.”

Closing the co-op will cost taxpayers $40 million, Colorado HealthOP said on Friday. The group blamed its troubles on “the federal government’s failure to pay billions of dollars in promised funding.”

Update 8:47 P.M.: This original article stated Colorado HealthOP marketed Obamacare as “brosurance.” Those ads were made by Progress Now Colorado. The co-op did not use bros, but instead hired models to market Obamacare in their panties in the early days of the healthcare law. We regret the error.